Hi everyone!

I’m sorry I have been MIA this past month. I was enjoying my last month downtown. Also, I had a ton of visitors back-to-back this past month, almost right up until my last day downtown. I am back home with the ‘rents now so I have more time.

I have a post I want to do about saving money while living and having fun in the city. Before I do that though, I should do my end-of-month report for August. Here goes!

As I mentioned up above, August was a busy month. It also felt like an expensive month, spending-wise. With all the visitors I had who wanted to enjoy the food of downtown Toronto about which I’d been boasting, I didn’t really cook as I do when I am normally on my own. In fact, I barely cooked. Consequently, my dining expenses for the month were more than double what they were in June and 57% more than what they were in July.

Behold the difference in spending on dining out (this includes coffee shops, which is where I have many work meetings).

DINING EXPENSES

| June | July | August |

|---|---|---|

| $177 | $237 | $371 (!!!) |

So far, not good.

However, if I also look at grocery spending and compare the totals of dining out and grocery shopping per month, it looks like this:

| June | July | August | |

|---|---|---|---|

| Dining Out | $177 | $237 | $371 |

| Groceries | $242 | $94 | $101 |

| TOTAL | $419 | $331 | $472 |

June and July’s spending on food are no longer far apart. Both are still hella high though!

Another big expense was a new laptop, which I finally bought after working with an old, slow one for way longer than I should have. Especially considering that on my laptop is where I do 90% of my work. More details about my laptop expense in a future post on saving in the city.

Besides those two aforementioned things though, almost all my other expenses were down or almost the same from the previous month. Here is a comparison of my biggest ones, minus loan interest payments:

| June | July | August | |

|---|---|---|---|

| Dentist & Health | $150 | $869 | $263 |

| Entertainment | $93 | $404 | $68 |

| Clothes | $210 | $84 | $6 |

In total, minus that laptop purchase and rent, I spent about $2157 in August. Compare this with June’s $2426 and July’s $2838. Keep in mind that these totals look high because they include close to $1000 of monthly loan interest payments and an average of $430 per month of dental expenses.

Although July’s total included tickets bought for future weekend trips, it is pretty surprising to me that my spending total for August is less than those of the previous two months. But I’m not going to complain!

Yay me for kind of spending less this month!

I also made a big effort to put more money towards my debt this month, more specifically toward my business school loan. I actually put money toward the debt before I received pay from my clients this month. I’m happy to report that my efforts again paid off this month. However, they came at the expense of my monthly saving goal. Since my main client was again late with their payments, I didn’t get much income for August until September. And I actually had to dip into my savings a little until I received the payments. Thankfully, I had built up a buffer of savings from the past year so I could survive just fine until I got paid.

Speaking of buffers, since I started paying off the principal balance on my MBA student loan in July my payment due date has been going further and further into the future. My next due date is now June 2015! My goal is to push it out at least one year ahead, in case I, for whatever reason, no longer have work and it takes me a year to find a paying gig. Would love to have the burden of paying my loan off my shoulders while unemployed.

Anyway, without further ado, here is where things stand as at the end of August:

| Name | July 31, 2013 | August 31, 2014 |

|---|---|---|

| Mastercard | $6,123 CAD | $0 |

| Visa | $8,653 CAD | $605 CAD |

| B-school loan | $96,800 USD ($105,503 CAD) | $87,382 USD ($95,238 CAD) |

| Ontario Student Assistance Program (OSAP) loan | $20,931 CAD | $18,883 CAD |

| Student Line of Credit (LOC) | $9,678 CAD | $0 |

| TOTAL | $150,888 CAD | $114,726 CAD |

It would seem that my debt has fallen below $115K! At the end of July, it stood at $119,428. By my calculations up above, the balance at the end of August is $114,726. Meaning, I paid off a whopping $4702. That seems fantastic! However…however…and here is where I become the bearer of bad news again…

Today, I remembered (after making a transfer of funds from a Canadian bank account to my US bank account) that my bank charges me higher than the actual exchange rate whenever I make a transfer. Worse is that I certainly noticed the downward trend of the Canadian dollar against the US dollar the first 6 months after I started tracking my debt reduction. And I most especially noticed a downward trend again in July this year. I finally went and checked the historical values today.

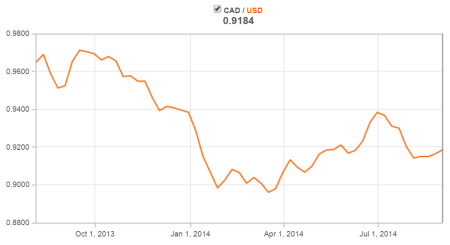

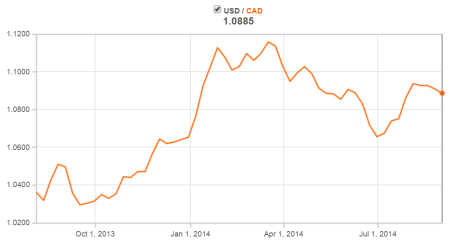

The two charts below are exchange rates from July 1, 2013 to September 9, 2014 (the date I am writing this post).

Here is a chart of the value of the Canadian dollar to one US dollar.

You can see that the Canadian dollar dropped from over $0.96 of a US dollar to under $0.92. As I mentioned in my first post, it sucks that almost the entire time I was in the US during grad school and afterwards when I was unemployed….In other words, when I had no income whatsoever, the Canadian dollar was at par or greater than the US dollar. I arrived in Canada and I swear it felt like the Canadian dollar literally began falling that very same day. The chart above, which begins a few months after I moved back, kinda proves my feelings correct. Do you see that depressing downward trajectory going to around February 2014? This year’s July and August were also looking dim. For the past few months, the Canadian dollar has been nowhere near where it was last year July. *sigh*

Here is another view of the same information. This second chart shows the US dollar expressed as one Canadian dollar.

*double sigh*

As you can see from the second chart, one US dollar is now equal to $1.0885 Canadian. My Canadian bank, however, charged me the rate of $1.1273 to do the wire transfer to my US account. At first glance, $0.0388 does not seem like a big difference. However, to my five-figure US dollars loan amount owing, that $0.0388 is a $3,390 CAD difference. Not an insignificant amount of money!

This, by the way, is one of the many reasons I have been focusing on paying off the business school loan first. I don’t want to continue losing money because of crappy exchange rates! And, while the Canadian dollar may yet rise again to equal the US, I think that the quicker I pay things off the less I will lose.

To be more accurate in the debt amount I have to pay off, I have decided to stop using the exchange rate of $1.0899 which I’d been using since July and instead start using a rate closer to the rate I am charged. I also want to use a higher rate because I am conservative when doing my financial planning.

Besides checking when I go do my transfers, I have not really been following the currency markets and have precisely zero idea whether or not the Canadian dollar is expected to rise or fall in the next year or so. Earlier I chose $1.0899 for my rate, although it was probably around $1.0589 on average, because I wanted to account for that increase bank rate. Now that the Canadian dollar has fallen even more (and the USD/CAD rate has risen) I think I should adjust my numbers. And yes, I recognize that the Canadian dollar seems to be on a little upward trend the past 3 weeks. However, as a financial pessimist, I am going to assume that it will fall soon, at least getting back to today’s level within the next 3 months.

So from now on, I will use an exchange rate of $1.1275 for my amount owing in US dollars (and pray that the rate falls in the future or does not go much higher, on average, than where it is today).

When I use the rate of $1.1275 for August, my new table looks like this:

| Name | July 31, 2013 | August 31, 2014 |

|---|---|---|

| Mastercard | $6,123 CAD | $0 |

| Visa | $8,653 CAD | $605 CAD |

| B-school loan | $96,800 USD ($105,503 CAD) | $87,382 USD ($98,523 CAD) |

| Ontario Student Assistance Program (OSAP) loan | $20,931 CAD | $18,883 CAD |

| Student Line of Credit (LOC) | $9,678 CAD | $0 |

| TOTAL | $150,888 CAD | $118,011 CAD |

That, my dear readers, is a $3,285 difference in amount owing. And, it makes the amount paid off in August only a measly $1,417.

Sad faces upon sad faces.

If I want to feel better I should think about how my total paid off in the 13 months is $32,877 or an average of $2,529 per month. To pay off $150,888 in 5 years, I need to pay off $2515 per month on average. At $2,529 paid off per month, I just hit that monthly goal.

If I want to feel A LOT better about things though I could also use that $1.1275 rate for last year’s July amount too to get a better idea of the progress I have made in comparative terms. My new-new table would then look like this:

| Name | July 31, 2013 | August 31, 2014 |

|---|---|---|

| Mastercard | $6,123 CAD | $0 |

| Visa | $8,653 CAD | $605 CAD |

| B-school loan | $96,800 USD ($109,142 CAD) | $87,382 USD ($98,523 CAD) |

| Ontario Student Assistance Program (OSAP) loan | $20,931 CAD | $18,883 CAD |

| Student Line of Credit (LOC) | $9,678 CAD | $0 |

| TOTAL | $154,527 CAD | $118,011 CAD |

Making my total paid off so far equal to $36,516 or an average of $2,808 per month. To pay off $154,527 in 5 years I need to pay off an average of $2,575 per month. Paying off an average of $2,808 would make me a few hundred dollars ahead per month, which is good!

I’m not sure which table to use. Should I use the same exchange rate for my entire payoff period (beginning July 2013) or should I adjust the exchange rate periodically, perhaps every 6 months? I am leaning toward going with the former because if I do the latter it makes my true progress harder to track as the amount paid off will fluctuate a lot when I make adjustments to the rate.

If any of you reading have an answer or any suggestions for how to handle currency fluctuations in my debt reduction tracking, please let me know in the comments!